PowerKwacha loans offer fast and low-interest loans online. we have included all the important details in this post so that you, the borrower and reader, can decide with knowledge.

Its advantages have made us to list it among the best 13 online instant mobile loans in Zambia, these loans are almost same with 14 best civil – servant loans in Zambia. Furthermore, if you are a civil – servant and you want a more reasonable instant loan try Zamloan or Biumoney.

PowerKwacha Loans Package

Small and Medium Enterprises (SMEs) are the backbone of Zambia’s economy, and PowerKwacha recognizes their importance. Their business loans offer essential funding for daily operations, expansion, and various business needs, enabling entrepreneurs to grow their ventures. You can borrow from as low as K100 to K5000. The interest rates of PowerKwacha loans are almost the same as ZamCash.

Eligibility and PowerKwacha Loans Requirements

To apply for a PowerKwacha loan, applicants must meet certain eligibility criteria.

The following are the main things required during the Application Process:

- A valid National Registration Card. prepare a neat NRC and upload it in your device files.

- You must be at least 21 years and above at the time of Application

- Clear all outstanding credits. This is done in order to increase the chances of being accepted.

Understanding these PowerKwacha loan requirements can help accelerate your online application process.

How to Apply for PowerKwacha Loans

Once you have put the things we have mentioned above in place visit Google Play Store and search for ‘’PowerKwacha App’’ download and submit all the details an App is requesting. Never provide false information!

After all is submitted, wait for the review, it takes about 10 minutes to 24 hours for the review to complete. Do not submit your Application more than once. Wait until you get feedback.

PowerKwacha Loans Interest Rates and Repayment Terms

PowerKwacha offers low interest rates, ensuring that borrowers get value for their money. Understanding the interest rates associated with your loan is crucial for managing repayment. The interest rate ranges from as low as 0.055% to 0.096% daily and between the annual interest rate is between 20.08% and 35.04% annually depending on loan amounts and tenure

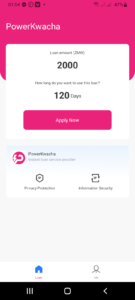

Repayment Options and Loan Calculator

PowerKwacha provides flexible repayment terms that align with your salary schedule. Using the PowerKwacha loan calculator, you can estimate your monthly payments based on the loan amount and interest rate, making it easier to plan your finances.

PowerKwacha Loan Disbursement.

Once your loan is approved, disbursement is typically quick, allowing you to access funds without unnecessary delays. Additionally, PowerKwacha offers top-up options for existing loans, giving you the flexibility to adjust your borrowing as needed.

What we like about PowerKwacha Loans:

- Low interest rates

- Fast approval

- Loan Calculator is available – you tend to know the repayment amount before applying

- Good customer support – quick responses when an issue arises

- The Mobile App is easy to use, it is not complicated and it does not take a lot of phone’s ram storage space

- You can create and or delete your account instantly

- The amount of loan ranges from as low as ZMW 100 to ZMW 5000

What we don’t like about PowerKwacha loans

- Website loan application method is currently unavailable (all applications are done through the App only)

- There is no referral program, hence no benefit for you when you give them a client.

PowerKwacha Customer Service and Support

PowerKwacha is committed to providing excellent customer service. If you have questions or need assistance, you can reach them via their PowerKwacha loan contact number or through their customer service portal. They are dedicated to ensuring that every borrower receives the support they need.

Here are their contact details: email: support@powerkwacha.com Phone number : 0773868979

Why Choose PowerKwacha?

PowerKwacha loans come with numerous benefits, including:

– Competitive interest rates that make borrowing affordable.

– Quick and easy online application processes.

– A variety of loan options tailored to meet diverse financial needs.

– Exceptional customer support to assist you throughout your loan journey.

With their commitment to flexibility and customer satisfaction, PowerKwacha is an excellent choice for anyone seeking financial assistance.

Conclusion:

If you’re in need of a reliable financial solution, PowerKwacha Loans could be the answer. With tailored packages, competitive interest rates, and a straightforward application process, PowerKwacha is well-equipped to help you meet your financial goals. To find out more contact them using the contact details we have provided earlier or visit their website at https://www.powerkwacha.app/