Financial needs can arise at any moment unexpectedly- ElitePay Loans is your solution. Whether it’s an emergency, expanding a business, or covering education costs, having a reliable and flexible loan provider is essential.

ElitePay loans is one out of 13 best instant mobile loans in Zambia. It is also feature in the list of 14 best Civil – Servant loans in Zambia. Its main features are very similar to Zamcash loans, Zamloan and Biumoney.

That’s where ElitePay Loans come in. ElitePay offers a wide range of loan options that are quick, easy to apply for, and designed to meet the unique needs of every borrower. In this review, we’ll explore what makes ElitePay the go-to option for personal, business, and student loans.

Introduction to ElitePay Loans

ElitePay is a leading provider of fast and affordable loans. With a strong reputation for quick approvals and flexible repayment options, ElitePay is ideal for individuals looking for fast financial solutions.

Why Choose ElitePay for Loans

ElitePay Zambia isn’t just about giving you a loan; it’s about offering a seamless experience from application to repayment. With competitive interest rates, easy-to-understand terms, and a user-friendly mobile app, ElitePay stands out among other lenders in the market.

Types of ElitePay Loans

Mainly, there are four (4) types of loans available from ElitePay Zambia:

ElitePay Loan Package

The ElitePay Loan Package offers a personalised salary advance program designed exclusively for employees of companies that have entered into a Memorandum of Understanding (MoU) with ElitePay. This ensures smooth access to quick funds, tailored to suit the needs of partner employees.

Business Loan

Their Business Loan solutions are specially crafted to support Small and Medium Enterprises (SMEs). Whether it’s for daily operations, expansion, or other business needs, ElitePay provides essential funding to help businesses thrive and achieve their growth potential.

Micro Personal Loan

ElitePay’s Micro Personal Loan is designed to offer salary advances that exceed 50% of your available debt capacity. This loan requires proof of employment and collateral such as vehicles, electronics, or other valuable assets. We also offer property-backed loans for those seeking larger amounts.

Import Duty Loan

ElitePay’s Import Duty Loan is tailored to assist with the costs of import duty for vehicles purchased from our trusted partners, including SBT Japan, Beforward, and Real Motor Japan. This package comes with added perks, ensuring smooth transactions and eligibility for import duty financing.

How to Apply for an ElitePay Loan

Applying for a loan with ElitePay is quick and hassle-free. Here’s how to do it:

- Visit the ElitePay website or download the ElitePay mobile app.

- Fill out the loan application form, providing necessary details such as your income, ID, and contact information.

- Submit the form and wait for approval, which typically takes just a few minutes!

Quick and Easy Online Loan Application

With ElitePay’s online application process, you don’t need to visit any physical office. The entire process can be done from the comfort of your home, ensuring a smooth and fast application experience.

Eligibility and Approval Criteria

ElitePay loans are accessible to a wide range of customers, but there are a few eligibility requirements:

- You must be 21 years or older.

- You need a valid form of identification.

- Proof of income is required to ensure you can repay the loan.

- Pay slips if you are in formal employment

How to Improve Your Chances of Loan Approval

– Ensure that your information is accurate and complete.

– Maintain a good credit history, as it increases your chances of approval.

– Apply for a loan amount that matches your income level.

ElitePay Interest Rates and Loan Tenure

Low-Interest Loans at ElitePay

ElitePay prides itself on offering competitive interest rates that are lower than many traditional lenders. This makes repayment more affordable and reduces the overall cost of borrowing.

Flexible Loan Repayment Terms

ElitePay’s repayment terms are flexible, meaning you can choose a repayment period that fits your financial situation. Whether it’s a few months or a couple of years, ElitePay allows you to repay at your own pace.

Understanding ElitePay Loan Tenure

Loan tenure refers to how long you have to repay your loan. With ElitePay, you can select the loan tenure that works best for you, ensuring that your monthly payments are manageable.

Disbursement and Loan Amounts

Quick Disbursement: How Fast Can You Get Your Loan?

One of the standout features of ElitePay is how quickly you can access your funds. After approval, the loan is usually disbursed within 24 hours, allowing you to take care of your financial needs almost immediately.

Loan Top-Up and Maximum Loan Amounts

If you’ve already taken a loan and need more funds, ElitePay offers loan top-ups. This feature allows you to borrow additional money without going through the entire application process again.

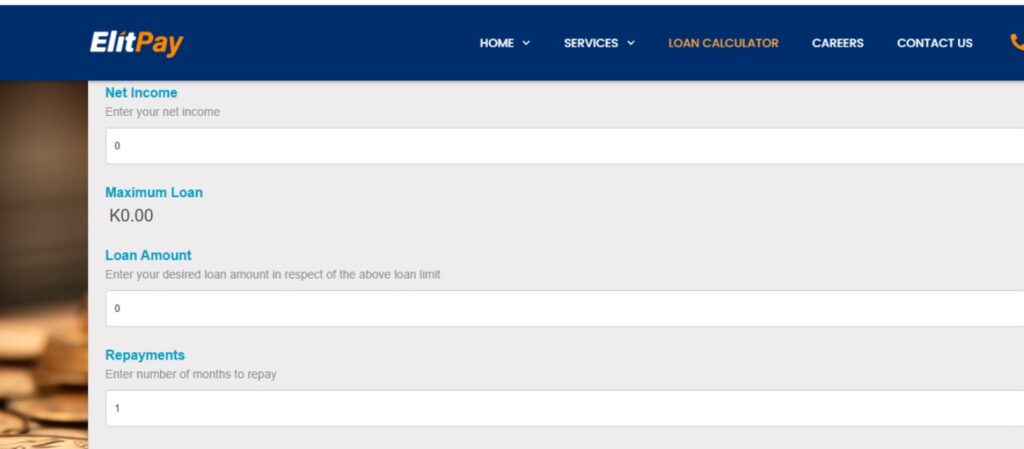

ElitePay Loan Calculator: Plan Your Finances

How to Use the ElitePay Loan Calculator

ElitePay loans provides a loan calculator on their website to help you estimate your monthly payments. Simply input your loan amount, interest rate, and repayment period, and the calculator will give you an estimate of your monthly payments.

Calculating Loan Repayments with ElitePay

Using the ElitePay loans Zambia calculator, you can easily determine how much you’ll pay each month, helping you plan your finances accordingly.

ElitePay Debt Management and Flexible Loan Options

Managing Debt with ElitePay’s Flexible Loans

ElitePay offers flexible loan options that allow you to manage your debt efficiently. Whether you need a longer repayment period or are looking for debt consolidation options, ElitePay can help.

Debt Consolidation Options with ElitePay

If you have multiple debts, consolidating them into a single loan through ElitePay can simplify your repayments and potentially lower your interest rate.

Customer Reviews and Testimonials

What Customers Are Saying About ElitePay

Customers consistently praise ElitePay for its fast loan approvals, low interest rates, and excellent customer service

Success Stories from ElitePay Loan Users

Many users have successfully used ElitePay loans to cover emergency expenses, grow their businesses, or fund their education. ElitePay’s commitment to fast, reliable service shines through in the positive feedback from its customers.

Conclusion:

If you’re looking for a fast, reliable, and affordable loan, ElitePay is a top choice. With a wide range of loan products, flexible repayment options, and excellent customer support ElitePay ensures that you have the financial help you need, when you need it. As long as you have checked the 9 factors to consider before getting a loan you are free to apply for a loan from ElitePay loans Zambia. For more information visit https://elitpayzambia.com/