ExpressCredit loans offer instant online loans for all civil servants without considering looking much about credit history of an individual.

The information below gives the reasons why ExpressCredit loans are super good for you and your family – just like Zamcash, Biumoney and Zamloan

In addition, we have explained in detail how to get a loan from them, interest rates, loan tenure, maximum amount, minimum amount and the requirements and why we have ranked it among the best 14 best loans for civil servants in Zambia.

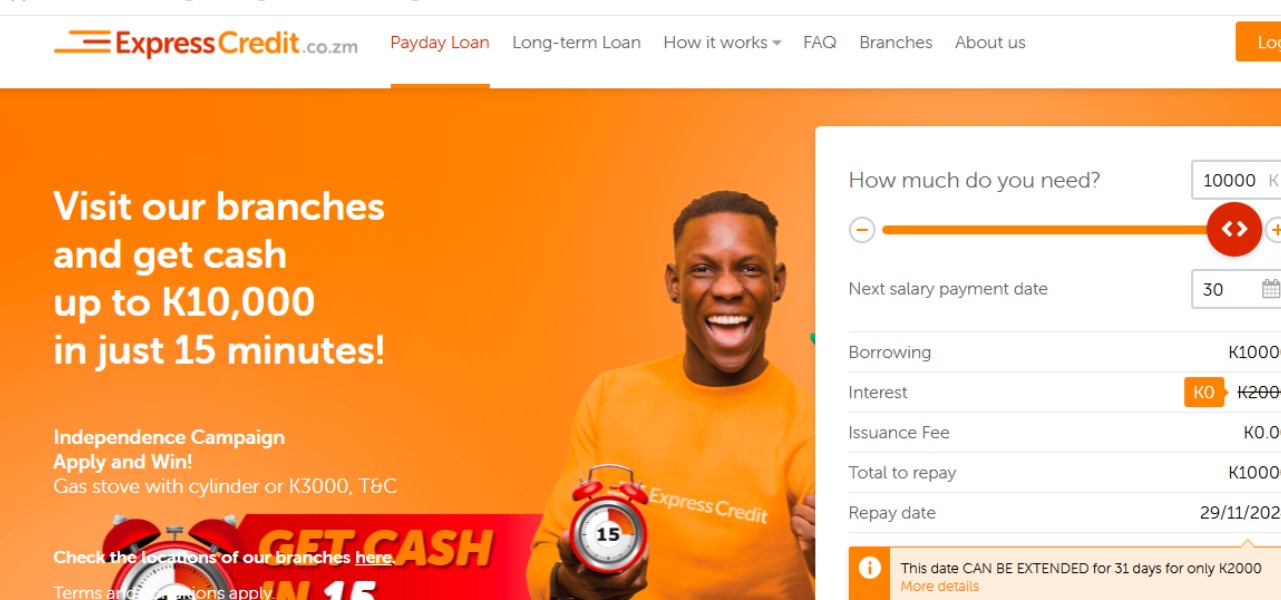

ExpressCredit loans is a financial institution that has been providing innovative loan solutions to Zambians since its initial inception. With a strong focus on customer satisfaction and fast service, the company has gained a good reputation for offering quick and convenient loans up to K20,000. ExpressCredit understands the financial needs of Zambian civil servants and provides loans designed to meet these demands while ensuring an awesome borrowing experience.

Why have we decided to recommend ExpressCredit Loans Zambia? (Key Features of ExpressCredit loans)

ExpressCredit stands out for several reasons, especially when it comes to Zambians serving civil servants. Here are some of the key features that make their loan offerings more attractive and convincing:

- ExpressCredit offers near-instant loan approvals, meaning you can get the funds you need quickly without a lengthy approval process (within 10 minutes)

- You can apply for a loan from anywhere using the online platform, saving you time and eliminating the need to visit a physical branch.

- The loan amounts offered are designed to meet the unique needs of civil servants, with flexible loan limits based on salary and financial requirements.

- ExpressCredit loans offer flexible repayment options to ensure that civil servants can pay back their loans at a pace that suits their financial situation.

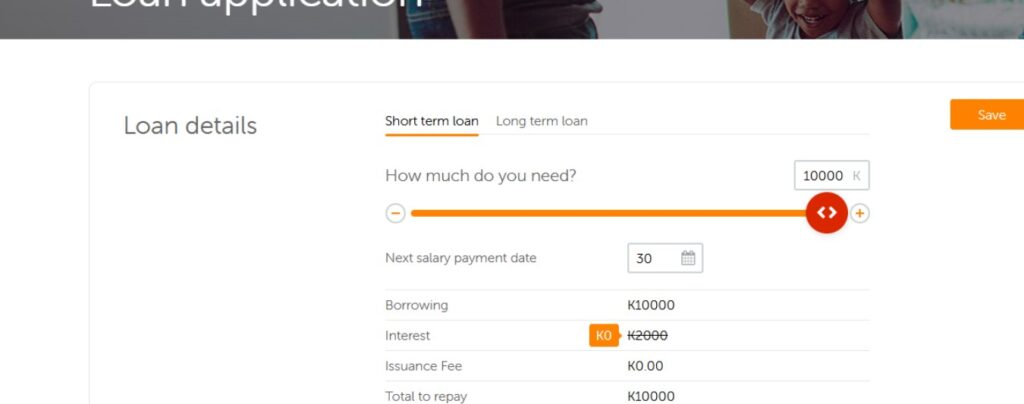

- There are no hidden fees or charges, with all interest rates clearly outlined during the application process.

Why ExpressCredit Stands Out specifically for Civil Servants Loan?

Civil servants in Zambia often face unique financial challenges, including long wait times for traditional loans or difficulties in securing collateral. ExpressCredit loans offer several advantages tailored specifically for government employees:

– Unlike many financial institutions, ExpressCredit does not require any form of collateral to approve a loan, making it easier for civil servants to access credit.

– ExpressCredit loans allows for loan repayments to be deducted directly from your salary, making the process seamless and stress-free.

– Once your loan is approved, the funds are disbursed directly into your account in as little as 24 hours, providing immediate relief when you need it most.

– Even if you have a low credit score, ExpressCredit still offers you a chance to qualify for a loan, giving you the financial boost you need.

Eligibility Requirements for all Zambian Civil Servants

To qualify for an ExpressCredit loan, civil servants must meet specific eligibility criteria:

– Be a government employee with a steady salary

– Provide proof of employment, such as a payslip

– Have an active bank account to receive the loan funds

– Submit valid identification documents

How to Apply for ExpressCredit Loans Online [ step by step procedure]

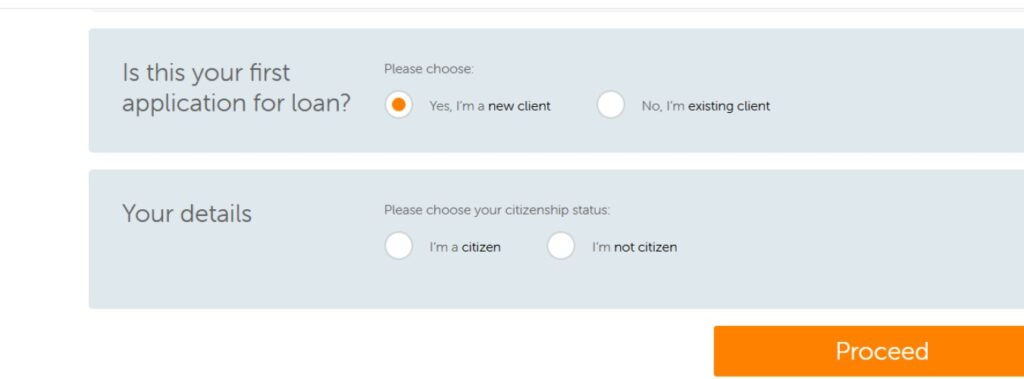

One of the biggest advantages of ExpressCredit is its online application process, which is easy to complete. Follow these simple steps to apply for a loan:

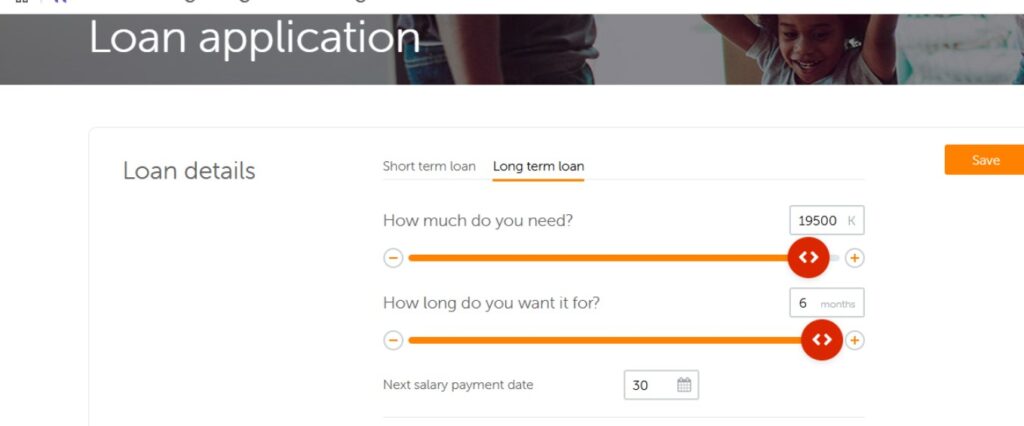

- Visit the ExpressCredit website: Navigate to https://www.expresscredit.co.zm/loan/apply/short-term

- Select the loan option that best suits your needs, such as a per day loan or long term loan

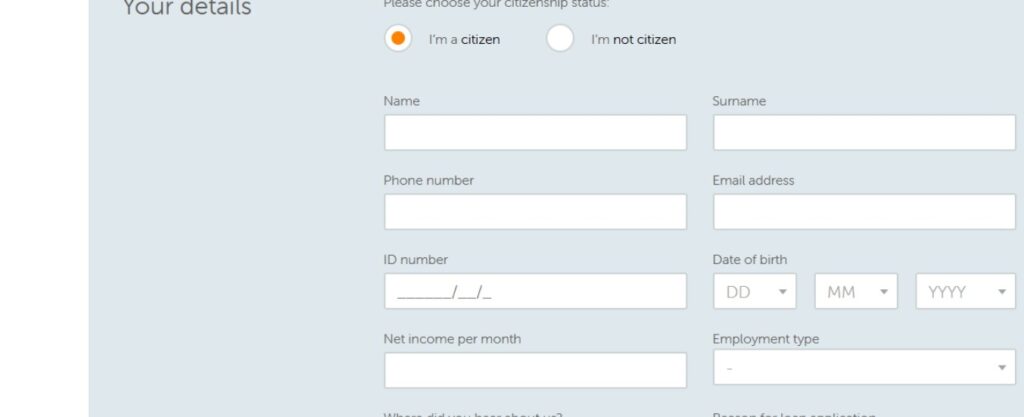

- Fill out the application form with your personal details, employment information, and desired loan amount.

- Submit the necessary documents, including your government ID and payslip.

- Wait for approval, which typically takes just a few hours.

- Receive your funds in as little as 24 hours upon approval.

Repayment Plans and Options for Civil Servants

ExpressCredit offers flexible repayment terms, allowing civil servants to tailor their loan repayments according to their salary schedule. With payroll deduction, loan repayments are automatically taken from your monthly salary, ensuring that you never miss a payment.

This system not only simplifies repayment but also reduces the risk of default. Civil servants can rest assured knowing that their loan repayments are automatically managed, giving them peace of mind.

Frequently Asked Questions About ExpressCredit Loans

Q: How much can I borrow from ExpressCredit?

A: The amount you can borrow depends on your salary and financial history. ExpressCredit offers flexible loan amounts designed to meet civil servants’ needs.

Q: How long does it take to get approved for a loan?

A: ExpressCredit typically approves loans within a few hours, and funds are disbursed in as little as 24 hours.

Q: Do I need to visit a branch to apply?

A: No, the entire process can be completed online, making it convenient for busy civil servants.

Q: Can I repay the loan early?

A: Yes, ExpressCredit allows for early repayment without penalties, giving you flexibility in managing your loan.

Conclusion:

ExpressCredit is a reliable and efficient financial partner for Zambian civil servants. With its fast approval process, no collateral requirements, and flexible repayment options, it is the go-to solution for anyone looking for instant financial assistance. Whether you’re facing an unexpected expense or need a quick cash boost, ExpressCredit has you covered.