For Zambian Civil Servants accessing a loan is a straight forward and some kind of simple task with 99% chance that one will get it. Unfortunately, traditional loans have a long process to be accessed. Thus why we have listed down 14 instant loans for Civil Servants in Zambia – for those who may wish to have their loans accessed online without paperwork or visiting traditional banks. We also have a reviewed list of 13 instant mobile money loans in Zambia for non government workers.

Some of the them we have used them before while others are just ranked in accordance to customers feedback and investigating their magnitude of interest rates.

Our Top 3 Picks

BiuMoney

Biumoney is an Instant Online Loan for Civil Servants who may need money from K10,000 to K30,000 plus Instantly.

Zamloan

Do you want your loan not to be deducted from your Salary Account? Zamloan is here for u. It offers civil servants online loan instantly.

ZamCash

Mostly suitable for borrowers who don’t like huge amount of money. Instant loans up to K3500 is offered by ZamCash online loans.

Civil servants play a crucial role in Zambia’s public sector, and with steady salaries, they often enjoy access to various financial services. Whether you’re looking for emergency loans, personal loans, or business financing, there are several options available for government employees. We have reviewed and ranked the best 14 instant loans for Civil Servants in Zambia, ensuring a variety of choices that suit different needs.

1. BiuMoney: Best Civil Servant Online Instant Loans

BiuMoney offers instant loans for Civil Servants, providing quick access to funds without the hassle of long paperwork. It’s an excellent option for those seeking online loans with fast approval. Their loan schemes focus on speed and convenience, making it ideal for salaried employees who need quick cash.

BiuMoney is here to make life easier for Zambia’s civil servants by providing a simple and reliable way to access cash when you need it most. Whether it’s an unexpected bill or an urgent expense, we’re all about getting you the funds you need—fast.

With BiuMoney, everything happens online. You can apply for a loan 24/7, right from your phone, and the best part? The process is super quick, so you could have the cash in your account within minutes. No fuss, no paperwork, and no collateral required.

If you’re a government employee looking for a convenient salary advance loan, BiuMoney is the answer. Anytime, anywhere, we’ve got your back with fast approval loans that fit your needs perfectly. We’re here to help you handle those financial bumps in the road with ease and peace of mind. We have tested its online procedure – it works perfectly.

2. ZAMLOAN

Zamloan is also one of the top instant loans for Civil Servants lender in Zambia. Its procedure for online loan application is very simple. Low interest rate flexible payments are both advantages of Zamloan. If you have applied for Zamloan but your application was turned down learn on how to re – apply and be accepted.

3. ZAMCASH

Zamcash lends money to all Civil – Servants, Casual workers and business men and women. Their loans attract only less than 30% per back interest. For you as a civil servant, the only challenge you may face if you access Zamcash is that it lends a maximum amount of K3500 only! Hence, as advised earlier, if you want more money try other options like Zamloan and Biumoney and thank me later.

For civil servants who may not be comfortable submitting their pay slips, Zamcash offers a solution. Their salary-based loans are accessible without the requirement of sensitive documentation, making it easier for government workers to obtain funding with minimal requirements.

4. UNIFI: Best for Civil Servant Salary Advance

UNIFI is known for its competitive interest rates, offering low-interest loans for civil servants. With easy loan eligibility criteria, government employees can enjoy financial support without exorbitant repayment rates, making it a top choice for those focused on cost-effective borrowing.

We can testify that UNIFI is one of the few institutions offering instant loans for Civil Servants which demands low loan interest to its borrowers. For the first time of accessing loans from UNIFI you will visit the office but after the first loan – all other loans are accessible online without office visitation. I do like their customer service interaction. Reward in form of food staffs are offered to the clients who repay the money on time. Furthermore, we have reviewed a lot of information about UNIFI Loans.

5. ExpressCredit: Best Loans for Civil Servants Who Want Business Loans

ExpressCredit caters to public sector professionals looking for business loans. If you’re a civil servant with entrepreneurial aspirations, ExpressCredit provides civil service loan programs designed to support both your job security and your business ventures.

According to their service, they make sure that you get instant loan up to K10,000 within 15 minutes from the time of online application.

6. IZWE: Best for Civil Servant Auto loans

IZWE offers public sector loans with flexible repayment terms. Civil servants can take advantage of payroll deduction loans that automatically manage repayments, making it a hassle-free option. Their civil servant loan schemes are structured to ensure fixed repayment terms that fit within a borrower’s budget.

IZWE loan has a multiple number of loan options and types such as Business loans, Car for Cash, landed property and auto loans. They have many branches in all districts of Zambia.

7. Lupiya: Best Loan for Civil Servants Who Want Money for Personal Use

Lupiya stands out as the best option for personal loans. If you’re a civil servant looking for instant loans for Civil Servants for personal use, Lupiya offers quick approval, affordable interest rates, and flexible terms to meet individual needs.

When you need cash for an emergency or planned expenditure, Lupiya’s loans for salaried employees ensure that public sector professionals can easily manage their financial needs. With Lupiya you can get up to K1000,000 loan for 36 months. Mainly, they have the following types of loans: Personal, Business and loans for women.

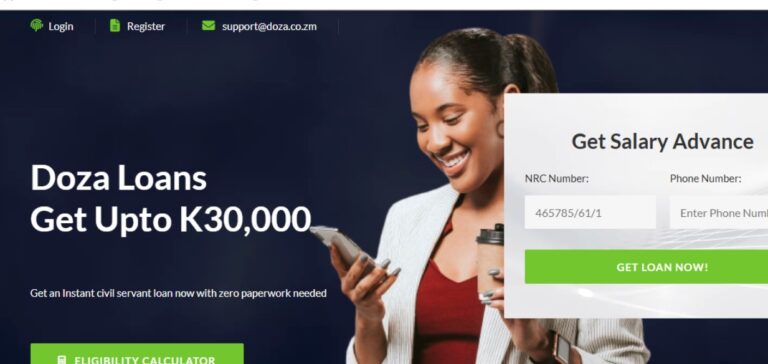

8. Doza

Doza focuses on civil servant loan eligibility and provides loans tailored to the needs of public sector employees. Their job-secure loan packages cater to government employees looking for financial stability and support in times of need.

With Doza loans online salary advance is available and they have a loan calculator to help you know in advance the total amount of money to repay. The maximum amount you can get as an instant loans for Civil Servants is K30,000.

9. Loanow

Loanow as its name suggests offers instant loans for Civil Servants schemes that prioritise quick access to funds. With a strong focus on emergency loans for civil servants, Loanow helps public employees tackle unexpected financial challenges, ensuring they have the necessary support when it matters most.

Once you upload all your documents the application is reviewed within an hour, – the call is made to inform you whether you qualify or not. Women empowerment loans and agriculture loans are also available.

10. BayPort

Bayport loans in Zambia are designed to make borrowing easy and accessible, especially for civil servants and salaried employees. They offer flexible loan amounts and competitive interest rates, so you can find an option that fits your needs, whether it’s for an emergency, education, or even a business venture.

The application process is simple, and repayment is manageable for all instant loans for Civil Servants often done through salary deductions or other convenient options. Bayport focuses on helping Zambians achieve financial stability with a service that’s reliable and supportive for real-life needs.

11. Spectrum Credit Zambia Loans

Spectrum Loans provides a comprehensive range of loan offers for public employees. With tailored loans for government workers, Spectrum focuses on enhancing access to both personal and business financing, allowing civil servants to maintain their financial well-being.

You can get up to K1000,000, loan calculator is available and the loan tenure starts from 36 months to 60 months.

12. Frontial Finances

Frontial Finances provides special instant loans for Civil Servants, offering loan discounts for government staff. Their civil servant financial aid programs are designed with government employees in mind, making their services affordable and accessible to a wide range of borrowers.

Frontial Finances offer a very quick instant loans for civil – servants up to K15,000 with flexible payment plans. With only four simple steps your loan will be disbursed in your account.

13. Chimera

Chimera offers loans for public sector professionals with a focus on job security and reliable repayment options. Their loans provide public employees with flexible terms and affordable interest rates, ensuring that civil servants can maintain financial stability while managing their obligations.

the maximum amount you can get from Chimera instant loans for Civil Servants is K100,000, the interest rate is as low as 20%. Apart from loans you can also invest money for good interests.

14. CreditCare Zambia

CreditCare is also a great choice for civil servants looking for a reliable, supportive loan option. With flexible repayment terms, CreditCare permits you as a civil servant to select a repayment plan that you are comfortable with in your home budgeting, making it easy (icayanguka) for monthly payment deductions without stress. Their competitive interest rates mean you can get the funds you need without worrying about high costs.

CreditCare doesn’t just help with immediate personal needs, like handling an unexpected expense or improving your home; it’s also a fantastic choice for those looking to invest in their professional growth. Whether you’re interested in further education, skill-building courses, or other career advancements, CreditCare offers tailored support to help you reach your goals.

With a balance of affordability and flexibility, CreditCare stands out as a trusted partner for civil servants looking to improve their financial and professional well-being.

Conclusion

After looking at different individual Instant Loans for Civil Servants, three options rise to the top: These are Zamcash, Biumoney, and Zamloan. Each of these platforms stands out for its borrower-friendly features which we have clearly shown making them especially useful for Zambian civil servants, students, and business owners.

Zamcash is a great choice for anyone looking for instant, flexible repayment options and lower interest rates, easing the stress of monthly repayments (out of pay slips Biumoney is all about speed and accessibility, making it a go-to for those who need funds fast, without paperwork and collateral, – it is a sub category of Zamloan. Lastly but not the list, Zamloan brings a unique level of transparency and flexibility in eligibility, offering support to both new and returning borrowers alike – also suitable for those who want huge amount of money for the business without pay slip deductions.

When it comes to reliable, Instant Loans for Civil Servants solutions, these three services have your support in daily financial struggles regardless of your location as long as you are a Zambian civil servant. Whether you’re facing an emergency, planning for the future, or just need a little extra support, Zamcash, Biumoney, and Zamloan are excellent choices we have ever seen in all our reviews. If you know other instant loans for government permanent workers in Zambia the comment section is open you can tell us your views or ask questions for clarifications.