Have you ever tried to apply for Zamloan but nothing prevailed? Only to receive the message that ‘’you are currently not eligible!’’

In this article we have explained clearly the secret for Zamloan eligibility. By following our simple guide you will be accepted for Zamloan in very few minutes. Let us start the short journey. But for those who may still have no interest Zamloan loans, below are two(2) best Zamloan alternatives or check out for 13 instant mobile money loans in Zambia.

Zamloan Alternatives

ZamCash

Just like Zamloan, Zamcash offers online loans instantly into your mobile money account. The only two weaknesses of Zamcash compared to Zamloan are: – as of today K3500 is the maximum amount one can get and the maximum loan term is 30 days.

BiuMoney

Biumoney is very similar to Zamloan that’s why we have listed it as an alternative. it mainly focusses on permanent government workers who are willing to get a loan for business and other emergencies. Its process is fast and reliable. Try it and see for yourself. None has ever complained about it.

The Background of the information

Before I explain the main topic, I would like to let you the reader know why you could trust this information.

I am an entrepreneur who enjoys seeing people progressing through using the borrowed money ‘loans’ to be specific. The methods I do use to come up with such information are reliable and trustworthy as I have illustrated in the ‘’About Us’’ page. These are some of the ways i do use to gather information about loans accurately:

- Making direct contacts to loans service providers, sometimes i do visit their physical offices

- Consult the old clients and listen attentively to their negatives and positives

- Interact with loans provider websites and Apps to check their services

- Following loan providers social media platforms for the purpose of investigating how their clients are appreciating, complaining and making recommendations.

Using the same methods described above, I have made an active and serious effort to review Zamloan so as to provide hidden secrets and pros and cons of Zamloan. I have done the same with Zamcash and Biumoney.

What is Zamloan?

Well, Zamloan is an instant online loan service which offers loans to Zambian Permanent Government workers or civil – servants and also private sector workers with Zanaco accounts only.

Types of Loans Offered by Zamloan

To make the story short, it is not even necessary to start listing or describing the types of loans which Zamloan offers. This is because their loans could just be described as ‘’Instant online loans for civil – servants and private sector workers having Zanaco accounts. Whether you will use your loan for education, business, buying a posh car or meet an emergence – it is up to you.

Why Choose Zamloan?

As of now there are about 67 loan service providers in Zambia! Our work is to review almost all these loan providers and inform those interested in loans the best loan provider in accordance to their status, loan purpose and affordability. To see how we do this check for 13 instant money money loans in Zambia.

Currently, we only have two (2) instant online loans which offer a reasonable amount of money online to civil – servants and other private sector permanent workers. These loan services are Zamloan itself as being discussed and Biumoney.

Yes, others may offer loans but at a very minimal amount and high interest rates. Here are some the convincing reasons why we have recommended civil servants to choose Zamloan as a an excellent online and instant loan provider:

- It offers reasonable amount of money online

- No need for massive paperwork

- In most cases, no ‘’payslip deductions’’

- Low and affordable annual interest rates

- Quick loan upgrades

- Smart and quick loan disbursements (in mobile money accounts)

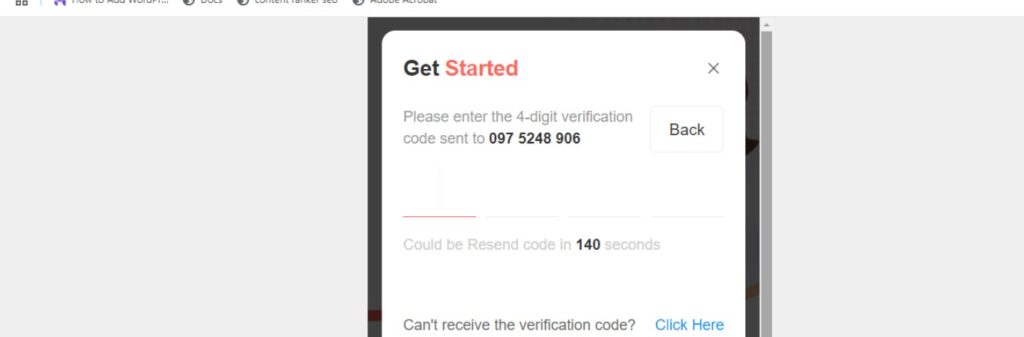

How to Apply for a Loan with Zamloan and be accepted?

This is our main subject to look at. If you are willing to apply for a loan from Zamloan, read carefully on this very passage. Applying for a loan is not a great deal or concern, anyone can apply at any time. But the challenging question to look at is; – will you be accepted? As we could guess , the majority of those reading this article have been rejected several times, unfortunately, the reason and the next step is not known until now!

For you and I to search for the solution(s) of an obstacle provided above we need to be aware of the factors considered for someone to be accepted for Zamloan. In other words how is the Zamloan system set to operate for this specific task of selection?

Here are the main factors considered by ‘Zamloan system’:

- The nature of work of an applicant

- The age

- Accuracy of the information provided during the application process

- The information of the device being used for application

- Number and nature of transactions performed on the mobile money wallet account provided by an applicant

- Credit history of an applicant

- The connection between the phone number provided and the bank account

- The age of the phone number or mobile money wallet provided

- The degree of accuracy and activeness of the contact (phone numbers) of family and workmates provided.

- What is the source of the link used for an applicant? Is it from scammers or is it a reliable link? Use a safe here.

Aha, have you seen and thought about the factors provided above? How many factors are you aware of? Where did you miss? Do you have one factor which seems impossible for you to work on? Great, so I am gonna use the same factors to explain in details how to increase the chances of being accepted as a Zamloan borrower. In most cases, it does not mean that your rejections are a true reflection that you are not eligible, rather it is a procedure of how the application was done.

So, what next?

How to re – apply and be accepted by Zamloan?

Here we are, do the following:

- Make sure that you are either a civil – servant or private – sector employee with a Zanaco account.

Zamloan provides its services to these two groups of people mentioned above. If you are not one of them please spend your internet bundles and battery power somewhere else – Zamcash is a great deal for you. Remember you cannot cheat a system as of today Ai technology is more smart than you think. I am sorry for this but that is the truth, if Zamloan extends its services to others i will definitely update the information. Currently, this is one of its weaknesses.

- Make sure that you are not a defaulter

Who is a defaulter? Any person who is given a loan and fails to pay back after an agreed duration. Check your C.R.B profile, are you innocent or you have a spotted garment of credits? During the application process you will be commanded to provide you N.R.C. the system will automatically use it to check your CRB profile. Sometimes, by luck you may be listed on CRB but be accepted. This can only happen if your credit risk is very low.

Furthermore, apart from being a defaulter, having one or multiple loans regardless of the amount can damage your reputation with Zamloan, especially credit from Zamcash and Biumoney!

All in all, my balancing point is before applying for Zamloan, check your credit history, make it clean.

- Age

If you are less than 21 (according to your N.R.C) don’t even apply, – loans are not meant for children and teens. I know this is not a problem with my reader but I have chosen to include it – just in case.

- The device being used for Zamloan application

Wow , I am aware that this could be a surprise to many but it just stands the way it is.Using the same ‘system’ mentioned earlier, the gadget matters. The system is able to detect the following from the device:

- How long as it been used by an applicant (the owner of the email account connected with the device)

- Where is the SIM card provided by an applicant inserted? Is it from the same device or a different one? If it is inserted in the same device/gadget when was it inserted?

Having this information do the following:

- Use your own phone or computer during application, the device you have used for more than six months gives an extra advantage

- Make sure that the SIM card is inserted in the very same device being used for applications (all this is considered as a firm identity/ownership). Considering these two factors (on device) you can easily deduce that a mobile smartphone is more advantageous than a computer of anytype.

- Work on the phone numbers you want to submit:

During the application, it is a must that you provide the phone numbers of yourself, family members and workmates.

Don’t submit these numbers for the sake of ‘filling in the blanks’ phone number is an eligibility factor in all online loan applications.

On part of your family member (s), please provide the one from your contact list (the one of the same surnames adds more value). The number must be registered in his or her own details, no miss match! The name numbers must show the consistency of activeness in terms of internet usage, text messages and live calls. Avoid submitting numbers of rare frequency usage!

Number(s) of workmates, when submitting these numbers make sure that the same criteria is considered as explained in the part of family members. Indicate the numbers of workmates of the same ministry. Choose the numbers from your contact list, especially those you do chat with frequently. If it is easy for you to tell them, just in case of anything – like calls from Zamloan.

Let us continue, now on part of your phone number (s);

- Use a phone number which is registered (long time) in your details. New numbers must be avoided at all costs.

- To add another advantage, provide a phone number linked to your salary bank account (this is another proof that you are a civil – servant). To those who are serious with what they do, use the same number to transfer money from salary bank account to mobile money wallets e.g from the bank to Airtel or MTN money.

- Make sure that a phone number provided is active on mobile money – it is used for sending, receiving, bill payments and many more transactions

- The Source of a link Used (Zamloan Safe link is below)

Again to some of the readers this could raise a negative argument but still – consider it to be a factor. Due to rampant internet fraud links are considered in loan eligibility. Here is an example, suppose you are reading this information using your Techno phone – your own device, later on you decide to use a different device for application, how do you see that in terms of online presence identification, especially if we could consider the information provided earlier?

Just like other instant online loan services, Zamloan is a business which could not afford to disburse their loan to people whom their identity are questionable. Our links are safe because we got them officially from Zamloan system. Hence, they tremendously increase the chances of Zamloans eligibility acceptance provided that all other factors discussed are dealt with.

At this moment one of the great questions could be; must I work on all factors provided in order to have my Zamloan approved? The undoubtable answer is YES! (in Mwine Mushi’s voice).

How? All the factors provided are clean, simple and clear, unless you have an intention of not repaying a loan. According to my observation, this has been one of the major factors that most loan applicants are rejected. They tend to provide ‘half truth’ details so that incase of a failure to pay the owners of money will hardly identify them.

These secrets are only workable to those who are honest in their applications – they have a repayment intention in their minds that the loans are meant to be put in good use – not like a biblical prodigal son.

The other great deal and a question could be; what if i have worked on all the provided secrets but still i am ineligible what could be the problem? And what is the solution?

Honestly speaking, I don’t think of a rejection after all is worked on. But just incase it happens, call Zamloan and here from their side. Lest they do it manually.

For the sake of keeping us moving, drop your comment, question or addition in a comment section at the end of this article. Your feedback matters a lot to us than you think.

Who Can Benefit from Zamloan Services?

As it is stated earlier on the part of introduction, it is very clear that the beneficiaries are Civil – sufferers oh no civil servants and private sector whose salary accounts are connected to Zanaco Bank accounts. If, in future, there is an extension we shall let you know by updating this information. Zamloan is highly related to Biumoney in terms of loan services.

If you are a civil – servant looking for an instant online loan try Zamloan or Biumoney, you will never go wrong.

Zamloan vs. Other online Loan Providers

As you are aware of, Zamloan is not the only online loan provider in Zambia. There are a good number of them providing the same services. However, there exists some noticeable differences between Zamloan and other online loan providers.

The table below illustrates a summary of those noticeable differences and advantages.

| ZAMLOAN | OTHER ONLINE LOANS | |

| INTEREST RATE IN % | Less than 32 | More than 32 |

| LOAN AMOUNTS | ZMW 10,000 + | Less than ZMW 4000 |

| LOAN TENURE | 12 Months + | Not more than 3 Months |

| NATURE OF DEDUCTIONS | From Mobile Money Wallets | From Salary Bank Account |

| DOCUMENT SUBMISSION | Only Names and phone numbers | Names, phone numbers, latest pay slips, Ids and selfies |

| LOAN DISBURSEMENT DURATION AFTER ACCEPTANCE | Between 7 min & 15 min | Between 20 min & 24 hrs |

Conclusion

I have clearly proved that Zamloan provides an excellent opportunity for civil servants and private sector workers in Zambia who need quick financial assistance. By understanding the eligibility criteria and applying the outlined guidelines, applicants can surely improve their chances of securing a loan.

From maintaining accurate information, using a personal device for applications, to having an active bank account with Zanaco, all these factors play an important role in ensuring your loan application is not turned down. With its fast disbursement, reasonable interest rates, and minimal requirements, Zamloan stands out as a reliable solution for immediate financial needs of our hard working civil servants. Have a look and follow the steps to ensure your eligibility, and enjoy the benefits which come with Zamloan.

Let us know if you are successful in your application, questions are also accepted, drop your concern in the comment section.